Alumni Spotlight: Tim Short (WG'17)

Wharton Energy Network's Alumni Spotlight Series seeks to highlight Wharton and Penn alumni who are changing the game in the energy industry.

Our July edition spotlights Tim Short (WG'17). Tim is Managing Director within the KKR Infrastructure Investment team focused on the Energy Transition, Renewables, Storage and related energy infrastructure.

Wharton Energy Network: Tim, really appreciate you being up for the spotlight. Shall we dive in?

Tim Short: Pleasure to be here, let’s do it!

WEN: Tell us about your journey. It’s spanned PV engineering, advising the Australian government on climate policy, and power and renewables investment banking. How did your early experiences enrich your perspective by the time you found your fit as a principal investor?

TS: From an early age I had a passion for energy and science, which led me to renewable energy and ultimately the choice to pursue an engineering degree in photovoltaics (PV). I quickly learned that while the subject matter was interesting, it was industry that attracted me most – not so much the prospect of chasing electrons through silicon in lab coats and hair nets. I was fortunate to work for the equivalent of approximately two years full time as a PV process engineer, which helped inform my decision to pursue the financial and commercial side of the sector instead. Along the way, while writing a thesis on Renewable Energy in the Australian National Electricity Market, I had the opportunity to work with Malcolm Turnbull – the Australian Federal Minister for the Environment, and later Prime Minister – on climate policy.

These two early experiences were incredibly valuable in helping me understand two key ‘legs of the stool’ that are fundamental to principal investing in the energy sector: technology and policy. The third of course being the financial aspect, which one gains from those grueling years punching your investment banking analyst ticket buried in Excel models until the sun rises – for better or worse!

My time in engineering gave me a fundamental and lasting comfort with the technical aspects of what we do and what we underwrite – and most recently, the technological innovations that must be considered. Interestingly that background wasn’t the least bit helpful in Investment Banking – but as a private investor I have found it to be a crucial differentiator in a sector undergoing so much change across the board, demanding a thorough understanding of things like power flow, energy transformation, electric grids and power electronics.

My time in policy taught me a number of things. I greatly admired the practical, commercial acumen that Malcolm brought to the arena but observed the difficulties of enacting change in an environment demanding constant political compromise. Thus began the building of my conviction that real change may be better driven by fundamental economics and forward-thinking investment.

WEN: There’s a lot of talk now about the energy transition -- a transformation of the global energy sector from fossil-based to low carbon. What would you say is different now versus 10 years ago?

TS: That’s a great question – because while a lot has changed, some key pieces have moved more slowly than others. I would break the changes down into similar categories as before and then touch on the state of things today.

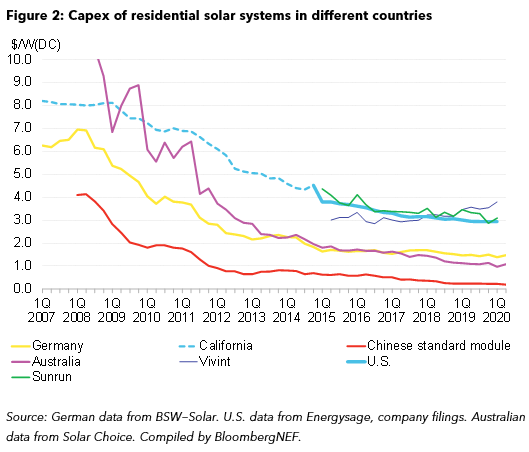

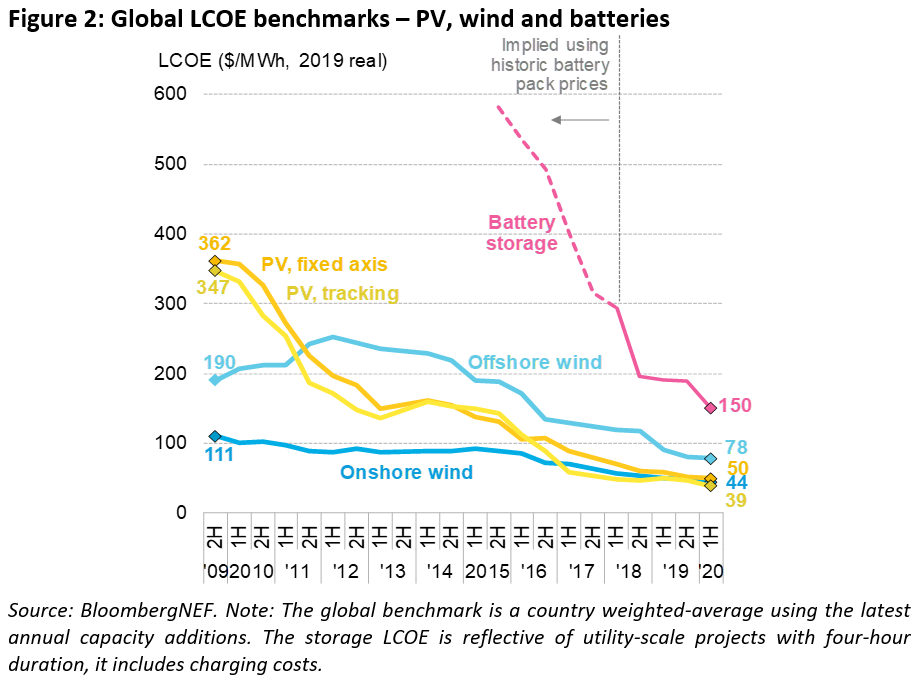

The first and arguably most powerful change has been technology – technological improvements, efficiency, production scale and associated cost reduction. In 2010, a PV module would cost just shy of $2/Watt. That would likely have been a 200W multi-crystalline silicon panel running at about 14% efficiency. Today, a utility-scale monocrystalline module costs closer to $0.20/Watt, and could easily deliver over 500W at an efficiency of over 21%. To put that in perspective, these declines have been passed on to residential PV systems: in 2010, it would have cost (pre-incentives and credits) approximately $,000 to fully power a US household with solar energy; today that cost is closer to $20,000 – and can be as little as half that after incentives. Those are incredible leaps, and we are now witnessing the same in energy storage. In the last four years or so, we have seen battery energy storage systems (“BESS”) costs come down by a factor of 3 – a point where forecasters a few years ago thought it would take 20 years to reach. Similarly, BESS have exhibited huge non-cost improvements in energy density and safety. What is fascinating about stationary BESS for utility-scale applications is that the sector is riding the coattails of the electric vehicle industry. Over 90% of Li-ion battery demand is coming from the mobility sector, creating global manufacturing scale that is expected to accelerate significantly as economies like Europe, the US and China demand ever more cleaner-running electric vehicles.

Source: Bloomberg New Energy Finance, 2020

Source: Bloomberg New Energy Finance, 2021

While technology has moved only in one direction, the political environment has seen wide dispersions in support levels, policy tools and progress. For example, while Europe has consistently led the pack with Feed-in Tariffs, the Kyoto Protocol, EU ETS (emissions trading scheme) and the Paris Climate Accord, Australia and the United States are notable developed-world climate policy laggards. Importantly, however, the United States has seen reasonably consistent federal tax credit-driven support and excellent state-level support that has helped create the world’s second largest renewable energy market (with China being the largest). Regardless, when the various (generally positive) policy support levers are paired with a wave of global net-zero and other corporate clean energy targets, massive technology cost reductions, and the ability for intermittent renewable generation to pair with storage, we will find ourselves at yet another ‘gap up’ for the scale of the energy transition investment opportunity.

Finally, the unprecedented support of financial institutions has been critical for what is different this time around. While in 2010, financing solar was seen somewhat inappropriately as a technology risk requiring a premium for lenders, today, contracted renewable energy can attract spreads on 20+ year fixed rate IG-rated private placement paper as low as 125 basis points over the appropriate index (in the US – and lower sometimes in Europe). We see this in the raw numbers: global asset financing for energy transition totaled approximately USD 175 billion in 2010 – whereas last year we nearly reached USD half a trillion dollars in the same category. Once again, those are some major changes in the right direction.

Source: Bloomberg New Energy Finance, 2020. Levelized Cost of Electricity (LCOE) is the net present cost of electricity generation for a plant over its lifetime. You can find a good primer to LCOE here.

WEN: Looking ahead to the next 10 years, where do you think the biggest opportunities will be? What role can different types of capital play?

TS: My first reaction is to call this the “million dollar question” – but in reality, this is the more like the trillion dollar question, or ten-trillion dollar question, depending on your perspective and outlook.

So, while there is a long and complex version of this answer, there’s also a simple way to break down some interesting, key themes worth highlighting.

Let’s start with what we know – or can at least have a high degree of conviction around. On of renewable energy, energy storage and electrified transport will continue to decline at an aggressive pace. We can be reasonably sure—especially thanks to BESS technology—that traditional fossil fuels will remain in decline. The outlook for global crude oil is probably the most dire: even the traditionally conservative IEA sees crude trading at less by $25/bbl by 2050 in their latest report, Net Zero by 2050. Oil is closely followed by coal, though that demise is heavily concentrated in developed nations initially, with emerging economies weening off the stuff more gradually (see IEA chart below). Natural gas on the other hand is likely to remain a pillar of the transition for a variety of reasons: its relative cleanliness, flexibility in production & consumption, room for technological improvement, application of CCUS (carbon capture, utilization and storage), and its ability to blend with hydrogen in the midstream pipeline network.

Source: International Energy Agency, 2021

What this all points to (and is already occurring) is a rapid move towards electrification that will be hard to stop. To get there, trillions of dollars will need to be invested most notably in new, clean power generation, the electric grid, new transport infrastructure and energy efficiency. How and where that capital is invested is more closely linked to the demand side of our equation, which is possibly more interesting and certainly more complex.

On the demand side, I would expect Energy-as-a-Service (EaaS) to emerge as a mega-theme of sorts. But that means a lot of different things. We are likely to see a move towards capacity-based pricing over energy- (e.g., volumetric) based pricing models. We will need data infrastructure, controls technology, and an appropriate sprinkling of AI to balance demand, supply, and emissions in increasingly sophisticated, real-time ways. Key concepts include things such as demand response, real-time energy efficiency (a better version of letting the utility turn down your factory, turn off your AC or manage your EV charging – all requiring further ‘IoT’ penetration), strategic load management (such as Google’s ability to shift load among data centers), minute-by-minute emissions footprint optimization (a monthly electric bill is not an accurate approach), autonomous vehicle dispatch and utilization (achievable with what’s known as “Level 5” driving automation) and of course, future technology improvements in areas such as hydrogen electrolysis or carbon capture.

These sorts of technologies will be key to facilitating USD trillions of investment into the supply side of the equation, focused on renewable energy generation, storage and heavy investment in improving our electric grids. But new business models will also be needed – including but not limited to “2.0” versions of ESCOs, utilities and energy management capabilities at the wholesale and retail level. Finally, in most economies, we’ll see a corresponding shift in the plumbing we know as the capital markets – new financial products, insurance, commodities and tradeable securities will emerge and bring their own set of differentiated opportunities for profitability. Solar revenue puts, weather- and climate change-linked insurance, tradeable renewable energy credits and carbon emissions derivatives are just the beginning of changes in financial products we are seeing already.

To wrap this up and answer the final component of your question, it is not hard to match the opportunities with their appropriate buckets of capital: VC firms will face a new wave of tech opportunities and business model innovations; infrastructure funds and institutional lenders will see trillions in hard assets needing to be built and financed; insurers will create products to provide for new risk management demands; growth and private equity will see a smorgasbord of companies that will benefit from thematic and sectoral growth – and some that will inevitably need management through distressed situations as energy transition runs further. Finally, energy trading desks will re-tool to provide liquidity in new instruments and strategies.

WEN: You recently joined KKR’s global infrastructure team focused on the energy transition, renewables, storage and related energy infrastructure. Could you tell us more about what you are up to? What are you most excited about?

TS: I’m excited about the enormous scale of the opportunity ahead: it’s not often in one’s career you can say with certainty that you’re sitting in the early days of an industry that is embarking upon a complete overhaul. With that level of change comes huge opportunity – for those that get it right yet remained disciplined around risk and return. It’s difficult not to sound like advertising when describing the culture, collaboration, and capabilities within the firm but that is what adds to the excitement and the opportunity. While I sit squarely within the infrastructure team, we routinely collaborate across pools of capital and similarly benefit from an integrated ecosystem of thought leaders, internal subject matter experts, capital markets teams and public affairs. To tie this back to my opening comments – successful investing has a number of legs to the stool: expertise across economics, technology, policy, business and finance are all key but are most successful in a highly collaborative environment like the one I’m fortunate to have recently joined. So that means we’re equipped to tackle energy transition from all manner of angles and capital perspectives. We’ve talked a lot already about the specific market opportunities – but at a high level, within infrastructure, we’re focused on investing in the hard assets that will underpin energy transition, as well as exploring value-added clean energy solutions for other infrastructure investments. That will mean a lot of solar, wind, and storage assets, while also building capabilities, platforms and supporting partners that will facilitate a differentiated roll out of capital across all the themes I’ve highlighted. It’s hard not to be excited about that.

WEN: How has being a Wharton alum helped you over the course of your career? What advice do you have for your fellow alumni to make the most of the community.

TS: I came away from Wharton with experiences and benefits that were very different from my expectations going in. Naturally, there are academic benefits—like engineering gives me more confidence with technical matters, Wharton added to my grasp of and confidence in a broader set of business concepts than I had before. To me this was important, having spent so much of my career in a reasonably specialized field. However, the best part was the diversity of people and perspectives, and how that broadened my own world view. In modern day professional work, we have to specialize, which typically limits our interactions to those who are directly in our field or one degree adjacent. Wharton taught me that we all live in the same business world and society at the end of the day – and that affords each of us a perspective that is unique and (hopefully) worthy of sharing so that we might learn from or enable others that perhaps aren’t in our everyday mirrors.

My advice to alums is quite different than my advice for graduates (I guess that’s a disclaimer). Honestly, I’d take this in a different direction and say: let’s do a better job . There are thousands of highly talented folks out there who have had the same great experience at Wharton that I did. Collaboration among accomplished professionals who share a common experience (Wharton) is incredibly fertile ground for informative, innovative and thoughtful dialogue. That doesn’t mean 5,000 people on a Zoom call but that does mean deliberate and active, stimulating connectivity. How we achieve that I think falls on us all … and no pressure on those charged with driving alumni interactions J

WEN: How do you recharge outside of life as an investor?

TS: Aside from the all-important time with friends and family – and the usual exercise and travel interests – I like to have a more involved ‘project’ of sorts running in parallel to balance things out. In the past that’s meant active goals like the NYC marathon or triathlon (I’m slow – it’s just about enjoying the challenge and personal accomplishment); attempting to build my skills in hands-on activities like cooking, landscaping, meditation (definitely haven’t cracked this yet) or carpentry; and almost always a real estate endeavor of some sort. And of course, at one point in time Wharton was that main project!

If you’re someone who is likely to throw a lot of your energy into work, I think it’s important to be deliberate about keeping up a level of personally satisfying pursuits outside of work. For me, this means to always exercise and to remember that you can learn something from everyone you meet – or they may end up playing a role in your life in a way you never imagined. When you look back on your life in 30, 50 or 70 years from now, it will be about your relationships with people, not the money you made – and that’s worth keeping in mind.

WEN: Tim, thanks so much for your insights. This was incredible. We hope Wharton Energy Network members get as much out of this conversation as we did.

- - -

Tim Short is Managing Director within the KKR Infrastructure Investment team focused on the Energy Transition, Renewables, Storage and related energy infrastructure. Tim has over 18 years of energy, power and renewables-related experience, with prior experience in solar (photovoltaic) engineering; power and infrastructure investment banking; and also served as a climate change advisor to the Australian Government. To date, Tim was involved in over USD 14 billion of invested capital in clean energy assets.

Previously, Tim was a Managing Director on the Clean Energy Infrastructure (“CEI”) team at Capital Dynamics in New York, having spent over 10 years growing the investment platform since its inception in 2010. Tim sat on the CEI Investment Committee as well as boards of selected portfolio companies and assets. He was responsible for investment strategy, origination, execution and management. While Tim covered all aspects of the CEI investment strategy, he was responsible for spearheading the platform’s distributed generation and M&A efforts, sharing coverage of energy storage opportunities. In 2019, Tim was awarded Power Finance & Risk’s Project Sponsor Finance Official of the Year.

Tim holds Bachelor's degrees in Commerce (Finance) and Engineering (Photovoltaics and Solar Energy, First Class Honors), from the University of New South Wales and an MBA (Honors) from the Wharton School at the University of Pennsylvania.

- - -